Insurance Plans for Cats from Healthy Paws

The Healthy Paws Pet Insurance plan covers your cat from nose to tail. It pays on your actual veterinary bill and covers new accidents and illnesses, emergencies, genetic conditions and much more.

How Pet Insurance for Cats Works

With Healthy Paws cat or kitten insurance, you can visit any U.S. licensed veterinarian including the specialists and emergency animal hospitals that can truly make a difference in your cat's care. The plan even covers alternative care. Please review your state-specific information regarding pet enrollment age and waiting periods for more details.1

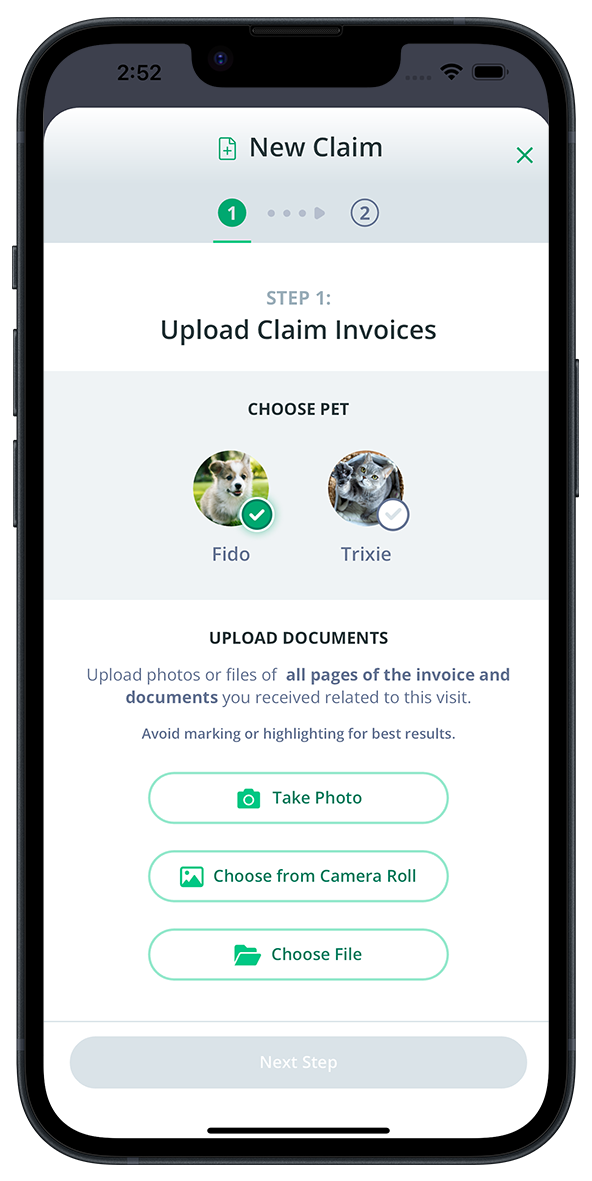

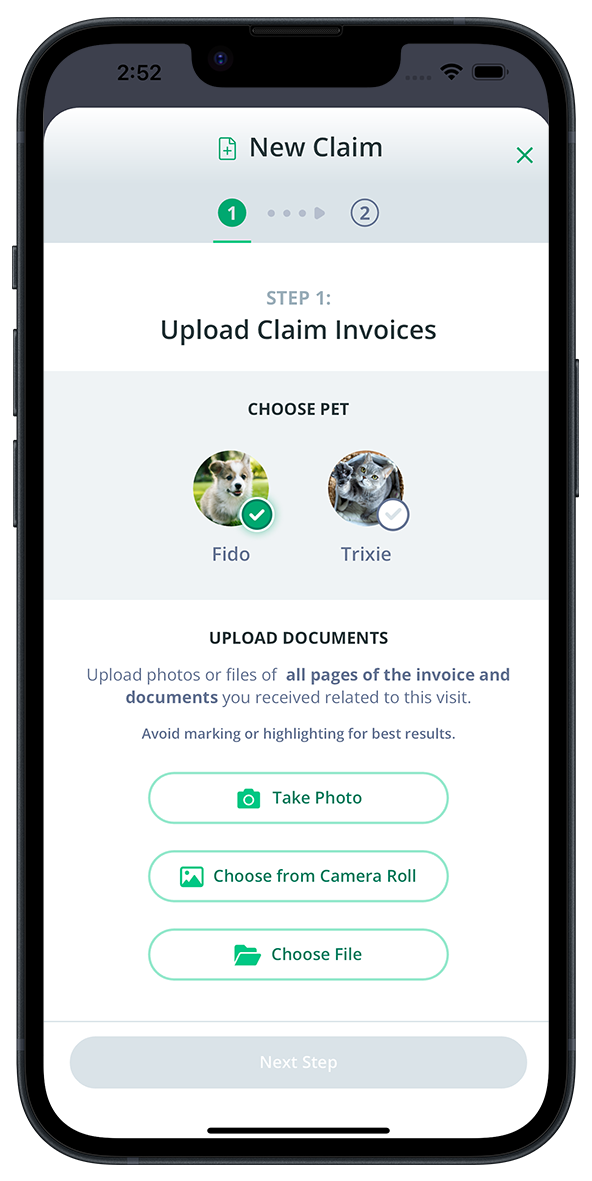

Cat Pet Insurance Claims. Fast, Easy, Worry Free!

With no more claim forms, we've created a fast and easy customer claim process. Just take a photo of your vet bill and submit it through the Healthy Paws mobile app or our online Customer Center. It's that easy!

We'll process your claims quickly (in fact, most claims are processed within 2 days) and you'll receive a reimbursement check via mail or you can sign up for direct deposit. Of course, if it's your first claim, we'll need your cat's enrollment clinical exam to complete your claim.

No More Claim Forms!

- Submit a claim from anywhere

- Submit a claim on your computer

- Real-time claims status

- Most claims are processed within 2 days

Is Pet Insurance for Cats Worth It?

Ryder, aka “trash cat”, loves to eat and this got him in trouble when he swallowed a piece of rubber. After numerous diagnostic tests, he needed surgery. When complications extended his hospital stay, his pet parents could rest easy knowing he was covered.

Condition: Ingested foreign object

Total Vet Cost

$7,774

The Healthy Paws Plan Reimbursed**

$5,969

Is Pet Insurance for Cats Worth It?

Ryder, aka “trash cat”, loves to eat and this got him in trouble when he swallowed a piece of rubber. After numerous diagnostic tests, he needed surgery. When complications extended his hospital stay, his pet parents could rest easy knowing he was covered.

Condition: Ingested foreign object

Total Vet Cost $7,774

The Healthy Paws Plan

Reimbursed**

$5,969

Common Health Issues Affecting Adult Cats

Adult cats can still experience injuries, and the odds increase for age-related illnesses as they get into their senior years. Cat insurance can help reduce the costs of veterinary care.

Common adult cat health issues include, but are not limited to:

- Feline immunodeficiency virus (FIV)

- Feline leukemia virus (FelV)

- Upper respiratory infections

- Feline lower urinary tract disease (FLUTD)

Common Health Issues Affecting Kittens

Kittens are curious to explore their surroundings and play with anything that could remotely resemble a toy, which means anything can happen. Getting pet insurance for your kitten can help ensure that any future accidents or illnesses are covered.

Common kitten health issues include:

- Ear mites

- Fading kitten syndrome (FKS)

- Soft tissue strains and sprains during play

- Intestinal parasites

"My cat has had a couple of surgeries in the last 3 years. They have always gotten my reimbursement checks to me very quickly (far faster than I would have imagined). The staff there is very kind, they are always asking how my cat is and checking up on us.”

- Jeff Z. on PetInsuranceReview.com

Pet Insurance for Your Cat - For Kittens to Senior Cats

When your cat gets too curious and needs emergency care or develops diabetes later in life that takes you both by surprise, the Healthy Paws plan can help you give your kitty companion the best medical care.

Kittens to five-year-old cats

Kittens and younger cats can get sick just as easily as older cats, experiencing illnesses like urinary tract and upper respiratory infections. Kittens are also incredibly curious and tend to eat things they shouldn't, like sewing needles and rubber bands.

Cats six and up

As your cats gets older, they may be affected by a hereditary or congenital condition that could cost you a fortune if you don't have pet insurance. With a Healthy Paws plan, you'll be protected for the lifetime of their policy. Just enroll your "purry" friend up until their 14th birthday.2

There's no age discrimination when it comes to the unexpected.

Join today and our Healthy Paws Pet Insurance team will be there to protect you and your cat from life's (mis)adventures.

Pet Insurance for Cats and Kittens Comparison

| What to Consider | Healthy Paws |

|

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pet Insurance Review rating (PetInsuranceReview.com 2024) | 4.9 | 4.7 | 4.9 | 4.4 | 4.9 | 4.8 | 4.5 | 4.6 | 4.9 | 4.3 | 4.8 | 4.9 | |

| No limits on any plans: no per-incident, annual or lifetime caps on payouts |  |

|

|

|

|

|

|

|

|

|

|

|

|

| All new accidents and illnesses covered |  |

|

|

|

|

|

|

|

|

|

|

|

|

| No restrictions on hereditary and congenital conditions 1 |  |

|

|

|

|

|

|

|

|

|

|

|

|

| Alternative care included |  |

|

|

|

Only as an add-on | Limited | Limited |  |

|

|

|

|

|

| Deductible type | Annual | Annual | Annual | Annual | Annual | Annual | Annual | Annual | Annual | Annual | Annual and/or per condition | Per condition | |

| Compare ASPCA |

Compare Embrace |

Compare Figo |

Compare Lemonade |

Compare Nationwide |

Compare Pets Best |

Compare Met Life |

Compare Fetch |

Compare Pumpkin |

Compare Spot |

Compare Trupanion |

Included

Included

Not included or some exclusions

Not included or some exclusions

Our Commitment to Our Customers

The Healthy Paws pet insurance plan for cats and kittens is easy to understand, it reimburses quickly, and you can count on us to help, especially when it comes to reducing the stress of caring for a sick cat.

Our commitment is to provide you and your cat with the best customer service and a great pet insurance plan. We are grateful to our pet-passionate customers for sharing their love of our care and service by rating Healthy Paws Pet Insurance as #1 at petinsurancequotes.com.

"Dealing with Healthy Paws Insurance is like dealing with a friend or family member. The service is very personal and it is exactly what a customer needs in times of trouble."

- Pascale on PetInsuranceReview.com

Common Questions About Pet Insurance for Cats

What does cat insurance cover?

The Healthy Paws plan covers the costs of veterinary care to treat new injuries and illnesses, including diagnostic testing, treatment, surgery, and medications. Coverage includes (but is not limited to): cancer, emergency care, genetic and hereditary conditions, breed-specific conditions, and alternative care.

When is the best time to buy cat insurance?

It’s wise to enroll your cat in pet insurance as early as possible before any illnesses develop since pet insurance does not cover pre-existing conditions.

Can I use any veterinarian?

Yes! With Healthy Paws, you can take your cat to any licensed veterinarian in the U.S. or while traveling in Canada, including emergency vets and specialists.

Is routine care covered?

No, routine care is not covered. Although wellness care is an essential part of responsible pet parenting, there is a clear distinction between a wellness plan and pet health insurance. The Healthy Paws plan is meant to help cover unplanned veterinary visits, including diagnostics, treatment, and medication for injuries or illnesses that can quickly become very expensive and aren’t as easy to budget for. Routine healthcare includes vaccinations, flea control, heartworm medication, de-worming, dental care, ear plucking, grooming, and prudent regular care.

Are there any caps on payouts?

With Healthy Paws, there are no limits on claim payouts, per claim, per year, or for the lifetime of your policy, so you can get your cat the care they need without worrying about reaching plan limits.

**Example reimbursement amount based on covered treatments using a 80% reimbursement level and a $250 annual deductible.

1 The Healthy Paws plan includes coverage for hip dysplasia when you enroll your pet before the age of six. Please review state-specific information regarding pet enrollment age and waiting periods for more details.

2 Maximum enrollment age varies by state.

The claim scenarios described here are intended to show the types of situations that may result in claims. These scenarios should not be compared to any other claim. Whether or to what extent a particular loss is covered depends on the facts and circumstances of the loss, the terms and conditions of the policy as issued and applicable law. Insureds providing testimonials have not received compensation for their statements.