Get an instant quote now and take the first step to protect your furry best friend.

We're here to make it easier for you to care for your pet and easier on both of you if your pet has an unexpected illness or injury. We're also here to make what we do and what we offer easy to understand. Below you will find information for commonly-asked questions about pet insurance from Healthy Paws.

Whenever you have a pet insurance question or need to review your options, please email us or call us at 1-855-898-8991.

Your insurance company is one of the following Chubb companies:

Policies are underwritten and issued by ACE American Insurance Company, Westchester Fire Insurance Company, Indemnity Insurance Company of North America, ACE Property & Casualty Insurance Company, Atlantic Employers Insurance Company, members of the Chubb Group.

With a Healthy Paws pet insurance plan, you will have continuous coverage for the life of the policy, without the concern of any type of per-incident, annual or lifetime caps.

To review a sample policy, please click here and enter the applicable state.

Hereditary and congenital conditions are eligible for coverage so long as the signs and symptoms first manifest after enrolling, and after any applicable waiting periods.

To review a sample policy, please click here and enter the applicable state.

For a comprehensive list of policy exclusions and limitations, download a copy of the Healthy Paws pet insurance policy here.

The most common exclusions encountered during the claims review process are:

Wellness and preventative care are not covered by your Healthy Paws policy. The plan is here for unexpected veterinary care.

Some examples of preventative care include:

To review a sample policy, please click here and enter the applicable state.

The pet insurance plan offers coverage for dental care related to traumatic injury, such as chipping a tooth. If injury to teeth is caused by an accident, we do cover the cost of extraction and/or reconstruction of damaged teeth.

By making the office visit part of a pet parent's financial responsibility, we can offer the accident and illness plan with no caps on claim payouts at a more affordable monthly premium.

All fees related to the professional opinion of a veterinarian are also excluded.

(Some examples of charges include: Examination, Medical Progress Exam, Recheck, Consultation, Specialist Consult, Emergency Exam, Office Call)

To review a sample policy, please click here and enter the applicable state.

The plan does not cover the cost of food, including prescription or special allergen diets.

The plan does not cover spaying and neutering.

Preventive healthcare including vaccinations are not eligiblefor coverage under the Healthy Paws plan.

As fellow pet parents, we understand this can be one of the hardest parts of pet ownership. The Healthy Paws plan can cover the costs of euthanasia when it is medically necessary for a covered condition. Expenses for aftercare, such as cremation or burial, are not eligible for coverage.

Example 1: Your dog has been itchy ever since you adopted her from the shelter. Over the past month she's been in several times to see her veterinarian for her itchy skin, loss of fur, and hot spots. Your veterinarian is treating the symptoms, but has not diagnosed the condition yet.

You enroll her. A couple of months later your dog has another flare-up of the same itchy skin symptoms and you take her to see her veterinarian, who prescribes additional medication.

This would be considered a pre-existing condition, since the clinical signs and symptoms of the condition existed before enrollment.

Example 2: Your cat is playing with a feather toy and ingests some of the string. Your veterinarian induces vomiting to expel the string and sends your cat home with some medicine to calm his stomach.

The accident inspires you to get pet insurance. Several months later your cat eats a hair tie and needs surgery to remove the foreign body.

This would be considered a separate accident and not related to the previous foreign body. They are both acute, isolated events.

To review a sample policy, please click here and enter the applicable state.

If you are aware that your pet has a congenital condition before you enroll in pet insurance, this condition would be considered pre-existing.

There are many types of congenital conditions that do not become apparent until sometime after birth. Healthy Paws will cover these types of congenital conditions as long as there were no clinical signs or symptoms present before enrollment or during any applicable waiting periods.

To review a sample policy, please click here and enter the applicable state.

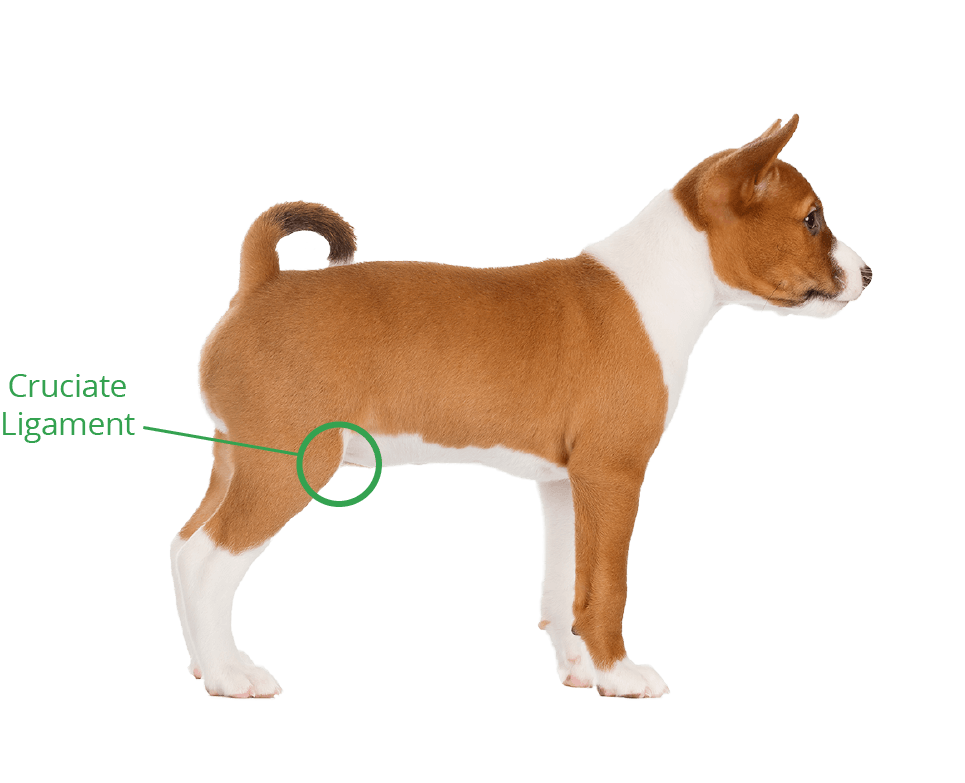

If your pet's complete medical records review shows no history of a cruciate ligament problem, and no history of limping, the injury is eligible for coverage. However, if your pet has shown lameness, or a full/partial tear before enrollment or during any applicable waiting period as defined above, on either side prior to enrollment, the other side is also excluded from coverage.

The cruciate ligament is the only bilateral* exclusion in the policy.

*Bilateral: having or relating to two sides; affecting both sides.

Click here for examples of the bilateral cruciate exclusion.

Example 1: Your dog has no history of limping or lameness prior to enrollment. Six months after enrolling, he comes home limping on his right leg after playing with his friends at doggie daycare. He is seen by the veterinarian and diagnosed with a partial anterior cruciate ligament (ACL) tear on his right leg, which will require surgery to repair.

Because your dog did not show signs or symptoms of any cruciate injury prior to enrollment or during the waiting period, coverage is available, subject to the policy's terms and conditions.

Eight months after this incident, your dog is diagnosed with a complete cranial cruciate ligament (CCL) tear in his left leg after he was seen for limping after a long session of chasing his favorite Frisbee. He will need surgery to repair this injury.

Because your dog did not show signs or symptoms of any cruciate injury prior to enrollment or during the waiting period, coverage is available for the second tear, which occurred on the other leg, subject to the policy's terms and conditions.

Example 2: Before enrolling in pet insurance, your dog has surgery on his right leg for a CCL tear that was recently diagnosed. This surgery was quite expensive and has inspired you to enroll in pet insurance to be protected against similarly large medical bills in the future. Twelve months after enrolling, you notice your dog is limping on his left leg after a long walk. Your veterinarian diagnoses your dog with a CCL tear in his left leg that will need surgical repair.

Because your dog showed signs or symptoms of a cruciate injury prior to enrollment, this would be considered a pre-existing condition. Due to the bilateral exclusion, the injury noted after enrollment on the left leg would be excluded from coverage, subject to the policy's terms and conditions.

To review a sample policy, please click here and enter the applicable state.

Here are a few additional examples of potential pre-existing conditions which may be excluded from coverage. Please note that coverage determinations can only be made based on all relevant facts and circumstances of a particular claim, the terms and conditions of the policy and any applicable laws. Your pet's medical history requires review to determine coverage eligibility.

If a pre-existing growth is malignant or cancerous, your Healthy Paws plan will be unable to provide coverage. If a pre-existing growth is benign, it would be unable to provide coverage for the pre-existing growth (for example the removal). However, new growths including cancer that occur after enrollment and applicable waiting period(s) would be eligible for coverage.

Some common benign growths include lipomas (fatty deposits), sebaceous cysts, papilloma (wart-like growths) and histiocytomas (firm inflammations on the skin).

To review a sample policy, please click here and enter the applicable state.

If your pet is diagnosed with an intestinal parasite prior to enrollment or during any applicable waiting period, the plan would not cover any follow-up care to this condition, including the recheck of the fecal sample or refill of medications.

However, as long as the parasite has been cleared up, your pet has had a negative fecal exam, and an exam where the stools were normal, then future instances of this condition would be eligible for coverage.

To review a sample policy, please click here and enter the applicable state.

If your pet is being treated for an ear infection prior to your coverage taking effect, the plan would be unable to provide coverage for any follow-up care to this condition. If your pet has a history of recurring ear infections, the plan would not be able to cover ear infections in the future.

If your pet had an ear infection prior to your coverage taking effect but does not have a chronic history of such infections or an underlying condition such as allergies suspected of causing infections, coverage may be available for future ear infections.

To review a sample policy, please click here and enter the applicable state.

Since urinary blockages have a high propensity to recur and are usually caused by underlying urinary issues, this would be considered a pre-existing condition if your pet was diagnosed with the blockage before enrolling. In that event, it would be unlikely the Healthy Paws plan would be able to provide coverage for urinary issues for your pet.

To review a sample policy, please click here and enter the applicable state.

If your cat had a bacterial urinary tract infection (UTI) when he/she was a kitten and it was resolved with antibiotics and without a special urinary diet, then the pet insurance plan may cover urinary tract infections in the future.

If your cat had a urinary tract infection with crystals prior to your enrollment (urinary crystals have a high propensity to recur and need further treatment or maintenance with a special urinary diet), the plan would be unable to cover urinary issues for your cat in the future.

To review a sample policy, please click here and enter the applicable state.

If the urinary tract infection (UTI) was an acute infection that resolved completely with antibiotics, the plan may provide coverage. If there are underlying urinary issues or your dog continues to experience chronic UTIs, this would likely be considered pre-existing. The pet's medical history would be reviewed to determine coverage eligibility.

To review a sample policy, please click here and enter the applicable state.

You can expect:

While you're helping your pet get better, we'll work on getting your claim processed.

A claim form is not required for claims processing.You can simply submit your claim by taking a photo of your invoice and uploading it through our online Customer Center or Healthy Paws Mobile App.

If you would like a claim form, you can download a pre-populated, personalized form in the My Account section of our website.

If you prefer, you can also submit your invoice(s) and supporting medical documents to claims@healthypawspetinsurance.com

fax (888-228-4129), or mail to:

Healthy Paws pet insurance

P.O. Box 50034

Bellevue, WA 98015

If you have questions you can email us at claims@healthypawspetinsurance.com or click here.

We are available Monday-Friday from 7:00am to 4:00pm PT and Saturday 8:00am to 5:00pm PT. We are closed on Sunday and Healthy Paws recognized holidays.

Yes! To maximize the annual deductible, we recommend that you submit all claims pertaining to new accidents, illnesses and injuries.

The annual deductible is by "coverage term" which is the twelve (12) month period that begins with the effective date of coverage and continues for each twelve (12) month period thereafter.

Reimbursements are based on your actual veterinary bills. Claims representatives determine the total of the covered treatments, if any, and multiply that by your reimbursement rate. They then subtract your remaining annual deductible.

For illustrative purposes only:| $ 1,200 | Covered treatments | |

| x 80% | Your Reimbursement Level | |

| $ 960 | ||

| - $ 250 | Remaining Annual Deductible | |

| $ 710 | Reimbursement Amount |

Your pet's deductible is annual, meaning it must be satisfied only once per policy term and resets on the anniversary of your pet's enrollment.

To review a sample policy, please click here and enter the applicable state.

Medical records for your pet include doctor's notes, laboratory results, and other documentation regarding all of your pet's visits to the veterinarian. These notes are kept by your veterinarian and are not typically sent home with you. If you are filing your first claim, the claims representatives need to review your pet's complete medical records. Please request your pet's full medical records from your veterinary office.

You can upload medical records or other documentation using the Upload Medical Records feature in your Customer Center.

Your veterinarian may also submit these records by emailing to records@healthypawspetinsurance.com or faxing to 844-333-0739.

There are two options for you to receive your reimbursements - Check or Direct Deposit.

Claim Reimbursement Method: Checks

Claim Reimbursement Method: Direct Deposit

If a claim is approved, any reimbursement due will be issued on average within 24 business hours.

Reimbursement via a mailed check can take up to 15 days to reach you, depending on your location.

Reimbursement via direct deposit may take up to 72 hours to process depending on your bank or financial institution.

To review or change your reimbursement method, just click My Account and 'Change Reimbursement Info' in your Customer Center.

In situations where you cannot pay your vet at the time of treatment, you may contact us to request payment directly to your vet in the event of a covered claim. You must make your request for direct payment in advance of the treatment to allow our claims team time to coordinate direct payment. Approval for direct payment does not mean a claim will be covered, and you will remain responsible for all amounts due.

In the event of approval on a covered claim, if your veterinary hospital is willing to accept direct payment, we can work with them to expedite access to your pet's medical records and the processing of your claim. This direct payment option is available for any licensed vet across the United States; it is not limited to any specific network of vets.

Direct payment on covered claims is available during business hours. Please call (855) 898-8991 and select the option to speak with a Claims Representative.

Congratulations on a new addition to the family!

You can use the

Add a Pet

feature in the Customer Center to add your new pet to your policy.

If you have a purebred dog or cat, simply select the matching breed from the dropdown list. By beginning to type the breed, you can search the list quickly.

If your pet is a crossbreed (usually one purebred dog bred to another purebred dog of a different breed), we have some of the most popular combinations represented in the breed list, including Puggle, Yorkiepoo, or Goldendoodle. If the crossbreed you're looking for is not represented on the list, choose "Mixed Breed" and the weight of your pet when fully grown.

If your pet is a Mixed Breed (a mix of multiple breeds, or possibly you're not sure what breed your dog or cat is), you can select the predominant breed in their mix, for example, "Boxer Mix" or "Terrier Mix." If the mix is unknown or not represented on our list, select "Mixed Breed" and the weight of your pet when fully grown.

Your pet's medical records will be used to verify the breed selection you chose during enrollment.

The annual deductible is by "coverage term." For example, if your policy became effective on May 25, 2022, your coverage term would last through May 24, 2023.

You can view examples of claim reimbursement calculations here.

To maximize the annual deductible, we recommend that you submit all claims pertaining to accidents, illnesses and injuries.

To review a sample policy, please click here and enter the applicable state.

Yes. You can lower your deductible and raise your reimbursement level as long as you have not submitted any claims. This would result in lower out-of-pocket expenses and a higher reimbursement, and correspondingly, a higher monthly premium.

If you have submitted any claims, you will only be able to lower your reimbursement and raise your deductible.

You can view your reimbursement and deductible options by clicking Pet Policies in your customer center to change your policy options, subject to the policy terms and conditions.

To review a sample policy, please click here and enter the applicable state.

If you would like to decrease the cost of your monthly premium, you can do this by lowering your reimbursement level and/or raising your deductible.

You can view your reimbursement and deductible options by clicking Pet Policies in your customer center to change your policy options, subject to the policy terms and conditions.

To review a sample policy, please click here and enter the applicable state.

To update your profile or billing information, please visit our website and select Sign In.

Log in with your email address and Healthy Paws password. There is assistance if you've forgotten your password.

Once you have logged in, choose My Account and select the information you would like to update.

Your monthly premium will be charged automatically to your credit or debit card each month on the same date that you enrolled. For example, if you enrolled on the 15th of the month, all payments moving forward will be deducted from the card on file on the 15th of each month.

For Pet Parents that enroll on or during the 28th to 31st of the month, the billing date defaults to the 28th because of February.

We currently accept any debit or credit cards issued by VISA, MasterCard, American Express, and Discover.

In accordance with the terms of the Pet Health Insurance Policy and the associated rating rules, monthly premiums may change for all policyholders. Premiums are determined based on the rates and rating rules filed with and approved by (as applicable), each state's insurance regulator, which reflect the cost of treatment advances in veterinary medicine, individual pet's breed, gender, age, and other factors, in addition to the overall claims experience for the program within the region where the pet resides. Premium increases are not based on your individual claim submissions.

We'd sure be sorry to see you go, but if you still want to cancel your policy, you can let us know via regular mail, fax, email or verbally. Once the account is canceled, you will no longer have access to the online Customer Center. Learn more about canceling your Healthy Paws plan here.

Still Have a Question?

Get an instant quote now and take the first step to protect your furry best friend.