Table of Contents

Introduction

Medically reviewed by Dr. Zac Pilossoph, DVM

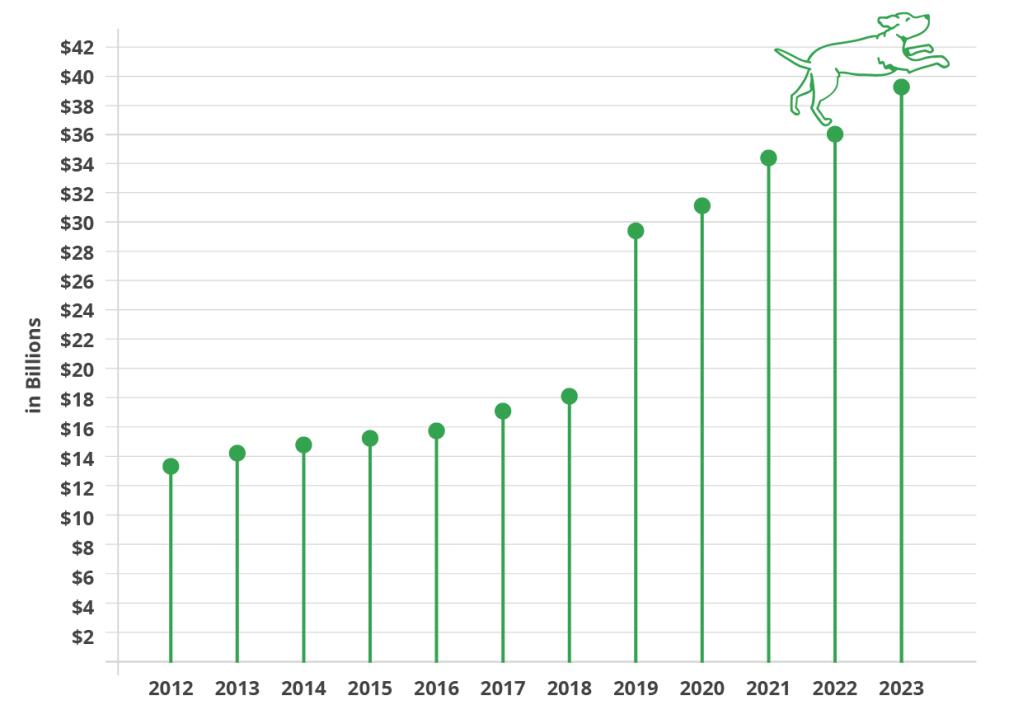

Anyone with a pet knows that vet bills can get expensive quickly and that the costs seem to go up every year. Pet parents did get a bit of a break on inflation in 2024, as the cost increases were far less than they have been in recent years, but veterinary costs remain on the rise.

Healthy Paws pet insurance has identified several reasons for the rising costs of pet health care, including advances in medical treatments, changes in the veterinary industry, and a growing willingness among pet parents to spend money to give their pets the treatment they need, just like any other family member. When it comes to our pets, it’s not just medical costs that racks up the bills. The American Pet Products Association (APPA) estimates pet parents will spend $150.6 billion on overall pet care in 2024, a 2.4 percent increase from 2023. Healthy Paws pet parents alone spent an estimated $588 million (less than a 1 percent increase from 2023) on accident or illness veterinary care, based on Healthy Paws claims data from Jan. 1 – Dec. 19, 2024.

37% of Americans don’t have $400 in savings†

–The Federal Reserve†

It’s heart-breaking to imagine turning down crucial treatment for your pet due to finances.

Those unexpected visits to veterinary emergency rooms can really hit the pocketbook when an emergency vet visit can range anywhere from $200 to $10,000. Thirty-seven percent of Americans don’t even have $400 in emergency funds.

This is where pet insurance can help. Pet insurance can allow you to go into vet visits with confidence, knowing that you can do what is best for your pet. The Healthy Paws plan insures new accidents and illnesses, including specialty and emergency care. With no caps on claims payouts and extensive coverage, pet parents can seek the care their pet needs with insurance helping protect against potentially high costs. For this annual report, we analyzed Healthy Paws’ claims records to identify the most common pet health conditions and their treatment costs so that pet parents would be aware when adopting a dog or cat.

The cost of veterinary care is increasing

- As medical care is constantly progressing, so is veterinary care.

- Procedures once only found in human medicine are now available for dogs and cats:

- Knee replacements

- Advanced allergy testing

- Cancer surgeries

- Bone marrow transplants

- Chiropractic care

- Technological innovations are increasing our pets’ quality of life.

- This comes with a corresponding price tag at the vet.

- A high inflation rate over the past few years has also impacted veterinarian services. Veterinary costs have risen by 38.5% since 2019, according to the North American Pet Health Insurance Association (NAPHIA).

- In recent years, private equity takeovers of veterinary businesses have led to higher prices and less competition as the industry consolidates.

Luckily, more people are choosing pet insurance – the number of pets insured across North America

North American Pet Health Insurance Association. (NAPHIA)

increased 20.9% from 2022-23.†

How does pet insurance work?

Pet insurance is for those unexpected accidents and illnesses you just can’t plan for — like when the dog eats something he shouldn’t or if the cat is diagnosed with diabetes. It works differently than human healthcare plans as it is reimbursement-based, so you don’t have to worry about a provider being “in-network” and can simply use any licensed vet (even emergency and specialty hospitals). With the Healthy Paws plan, you can give your pet the necessary care and may be reimbursed up to 90 percent of your covered vet bills. There are substantial differences between pet insurance policies which can affect coverage and claim reimbursement. The Healthy Paws plan covers new accidents, injuries and illnesses with no caps on claim payouts, and includes breed-specific, congenital, and chronic conditions. Customers benefit from this easy-to-understand policy and our personalized customer support. By getting health coverage for your furry family member, you can be there for them when they need you the most. After all, they’re always there for you.

How to get reimbursed for a covered claim

Key takeaways

We’ve talked to many pet parents, and many say they wished they’d signed up for pet insurance before their pet got sick or injured. They simply didn’t know how expensive vet bills could be, and they weren’t prepared financially. It’s heartbreaking to imagine turning down crucial treatment for your pet due to financial constraints. Here at Healthy Paws, we strongly believe that pets are family – in fact, we’re not alone! 85% of dog owners and 76% of cat owners believe this – and that you try your best to look after your family. Pets bring you joy, love, and good health, and you can return the favor by making pet health care a priority. More people are turning to pet insurance, with the growth rate in North American pet insurance enrollments increasing 16.7 percent from 2022-23. This allows pet parents to say “yes” to important vet care knowing they have insurance that can help them.

† Sources: The American Pet Products Association (APPA), Lending Tree, North American Pet Health Insurance Association. (NAPHIA), the Federal Reserve and Phys.org.

*Based on Healthy Paws pet insurance claims data between January 1, 2024 – December 12, 2024

The content is not intended to be a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your veterinarian or other qualified health provider with any questions you may have regarding a medical diagnosis, condition, or treatment options.

For full coverage details and exclusions, see a sample policy.

The claim scenarios described here are intended to show the types of situations that may result in claims. These scenarios should not be compared to any other claim. Whether or to what extent a particular loss is covered depends on the facts and circumstances of the loss, the terms and conditions of the policy as issued and applicable law. Facts may have been changed to protect privacy of the parties involved.

Insureds providing testimonials in this report have not received compensation for their statements.

Plan coverage varies based on the age of the pet at enrollment and the deductible and reimbursement levels chosen at enrollment. Exclusions and restrictions apply. All descriptions or highlights of the insurance being provided are for general information purposes only, do not address state-specific notice or other requirements and do not amend, alter or modify the actual terms or conditions of an insurance policy. Please refer to the terms and conditions of the policy, which set forth the scope of insurance being provided and address relevant state requirements.

Insurance offered by Healthy Paws Pet Insurance is provided by ACE American Insurance Company, Westchester Fire Insurance Company, Indemnity Insurance Company of North America, ACE Property and Casualty Insurance Company and Atlantic Employers Insurance Company and one or more of their U.S.-based Chubb underwriting company affiliates. Chubb is the marketing name used to refer to subsidiaries of Chubb Limited providing insurance and related services. For a list of these subsidiaries, please visit our website at www.chubb.com. This communication contains product summaries only. Coverage is subject to the language of the policies as actually issued. Surplus lines insurance sold only through licensed surplus lines producers. Chubb, 202 Hall’s Mill Road, Whitehouse Station, NJ 08889-1600.

© 2025 Healthy Paws Pet Insurance, LLC. All Rights Reserved.